IPA Advisory

|

i9

33

Figure 2

Transaction support in UK

and Ireland

IPA has advised a range of

clients investing in the Irish and

UK Renewable market to help

them understand the regulatory

environment and how policy

changes could affect the electricity

generation market and impact their

investment decisions.

A sample of recent transactions

that IPA has been involved in is

provided in Figure 2.

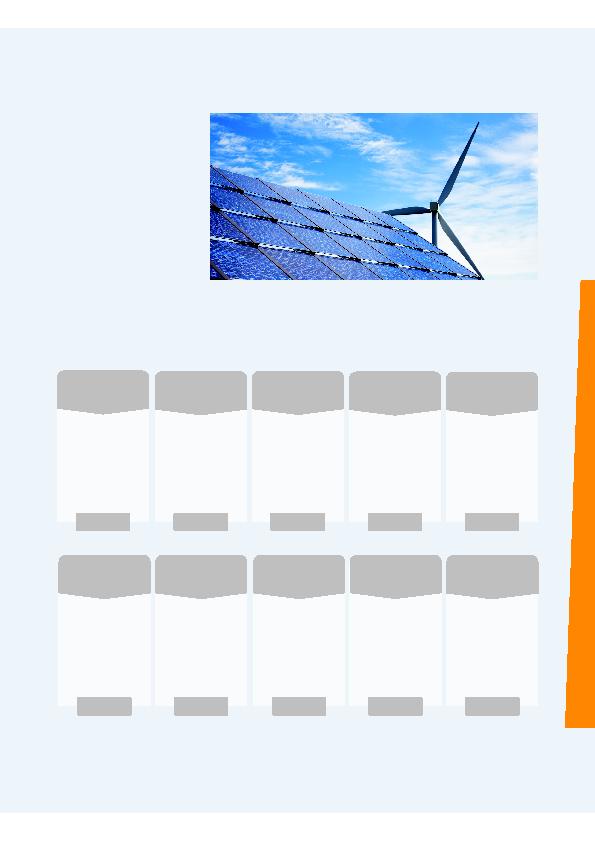

Recent transaction support in UK and Ireland

2014

Asian Investor

Commercial advisory

support for successful

acquisition of 50% stake

in onshore wind farm

portfolio including

long-term price forecasts

and achieved revenues

under PPAs.

2014

Infrastructure

Investor

Market advisory for new

build 16.5 MW biomass

CHP project, including

understanding of

complex offtake

structure under four

contracts, revenue

forecast model, and

assessment of impact of

EMR.

2013-14

Brookfield

Renewable

Energy Partners

Provided regulatory and

market due diligence

advisory for successful

acquisition and financing

of Bord Gais onshore

wind portfolio in Ireland,

including revenue

forecasts and impact of

I-SEM.

2013-14

Marubeni and the Green

Investment Bank

Green Invest-

ment Bank

Commercial advisory for

acquisition of 50% stake

in Westermost Rough

offshore wind farm

including long-term

market development,

revenue (electricity, ROCs,

LECs) forecasts, and PPA

termination value

calculation.

Green Invest-

ment Bank

2013-14

Commercial advisory for

acquisition of 25% stake

in London Array offshore

wind farm, including

long-term market

development and

revenues, due diligence

advice, and negotiation

support on PPA terms

and collar valuation.

2013

Asian Investor

Revenue and cost

forecasts for a potential

1.2 GW coal-to-biomass

conversion including

assessment of plant

operation and economics

under existing RO and

forthcoming CfD FiTs.

2013

Asian Investor

Commercial advisory

support for bid for stake

in Marchwood CCGT

including: long-term

electricity and capacity

market projections,

analysis of all commercial

revenue streams, and

review of tolling

arrangements.

2013

Hastings

Advised a successful

acquisition of Phoenix

Natural Gas from Terra

Firma, providing

forecasts for Northern

Ireland gas market and

potential growth of new

connections and supply

volumes.

2012-13

Icon Infrastructure

Electricity price and

market analysis for

biomass combined heat

and power plant

including impact

assessment of EMR,

forecast of ROC prices,

and value of LECs.

2010

Investcorp

Commercial advisory in

support of bid portfolio

of onshore wind farms in

GB and Ireland including

due diligence review of

existing power purchase

agreements (PPAs).

Caisse De Dépôt

Et Placement Du

Québec