public private partnerships (PPP). From our offices in San Francisco, we provide financial

and commercial advice to both government and private sector clients for large scale

infrastructure projects all over the U.S., Canada, and abroad. Our team members have

successfully closed over $100 billion worth of infrastructure transactions, and we are

helping to shape the dynamic and evolving PPP market in the U.S.

include assessing project feasibility, analyzing the most efficient delivery method,

structuring and running procurements to attract the most qualified and competitive

responses from the private sector, and negotiating terms with private sector partners.

project finance principles. We focus on maximizing return on equity without jeopardizing

the bankability of a project and ensuring the long-term stability of a project's financial

structure.

infrastructure challenges; to others they are a corporate takeover of important public

assets. In reality, they are neither. A well-executed PPP is simply another tool for procuring

or managing public infrastructure--albeit a new and increasingly popular one in the U.S.

a number of successful projects, tightening budgets, projects that are more complex, a

demand for better value for money, the desire to leverage private sector expertise, and

shifting public sector priorities.

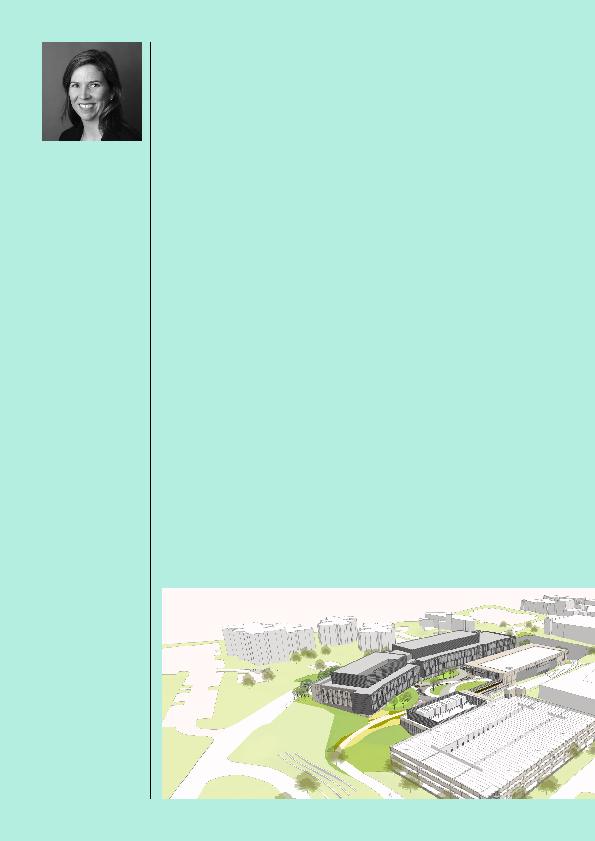

new Central District Campus

at the University of Kansas by

Perkins+Will, the developer

team's architect

Central District Campus as a

large-scale PPP, the design

of the new facilities could

be considered holistically,

integrating consistent design

concepts and incorporating

increasingly rigorous

performance goals for water

and material use. Many design

decisions were made from

a lifecycle perspective and

included the operator at

the table during the design

process

Victoria Taylor

President & CEO

Project Finance

Advisory, Ltd.

San Francisco

politically, and contractually complex arrangements. PFAL's team of experts

represents the highest standard from each of the disciplines needed to

structure a deal that can be financed in the capital markets.